The global orthopedic devices market is estimated at $60.4 billion in 2023 and is expected to grow at a CAGR of 4.3% from 2024 to 2030. Several factors, including the high prevalence of orthopedic diseases, an increasing aging population, a rise in degenerative bone diseases, and a rise in the number of road accidents drive the market. The early onset of musculoskeletal disorders caused by a sedentary lifestyle and obesity is expected to drive market growth further.

According to a report in The Lancet Rheumatology, the number of patients suffering from other musculoskeletal disorders increased by 123.4% from 221 million to 494 million worldwide between 1990 and 2020. The report predicts that cases of these diseases will increase by another 115% to an estimated 1.06 billion cases by 2050.

The growing adoption of robotics in orthopedic surgery has further fueled market growth. For example, Stryker UK Limited reports that approximately 13,000 patients are operated on with Mako robotic arms each month worldwide. Advanced imaging and real-time feedback in robotics define precision in orthopedic surgeries, reducing tissue damage and accelerating recovery time. Robotics is used to create personalized treatment plans, tailoring surgical procedures to individual anatomical features, thereby improving outcomes and reducing complications.

The availability of advanced orthopedic devices and the rapid development of healthcare infrastructure across the globe are expected to positively impact market growth. The rise in popularity of minimally invasive surgical techniques and the multiple benefits they offer is another key factor driving market growth. Moreover, the increasing participation in sports and physical activities has directly led to a rise in sports-related injuries requiring medical intervention, which is further expected to boost market growth. According to the American Academy of Pediatrics and the National SAFE KIDS campaign, more than 3.5 million children under the age of 14 are injured each year while participating in sports or recreational activities. Moreover, more than 775,000 children in the same age group are treated in emergency rooms for sports-related injuries each year.

The growth of the aging population is driving the demand for orthopedic solutions across the globe. As people age, their bones tend to weaken due to excessive bone loss, which is more common between the ages of 25 and 54. After the age of 55, the loss of bone density becomes more severe, thereby driving market growth. It is estimated that by 2030, the number of people aged 60 and over will increase significantly, with one in six people worldwide belonging to this age group. By 2050, this number is expected to double to 2.1 billion.

market segmentation

Analysis by Product

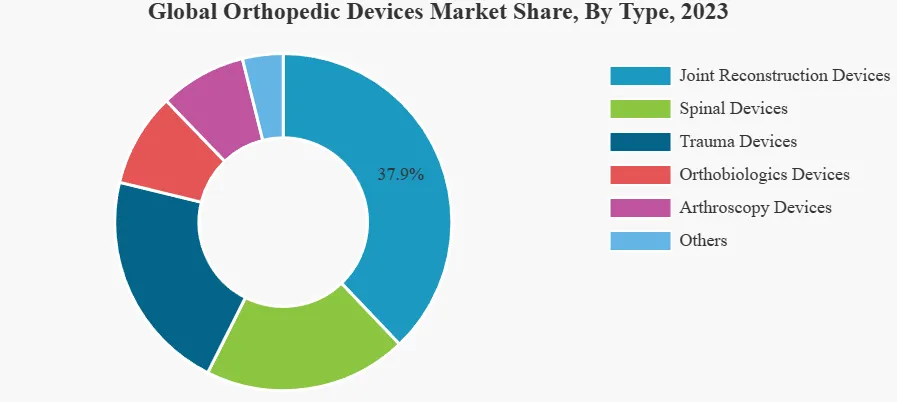

The joint reconstruction devices segment is dominated by the rise in knee and hip replacements. Based on type, the market is segmented into spinal devices, joint reconstruction devices, trauma devices, bone biomaterial devices, arthroscopic devices, and others. Among them, the joint reconstruction devices segment accounted for the dominant share of the market in 2023. The increase in the number of shoulder and limb reconstructions, knee and hip replacements, and other musculoskeletal surgeries related to these joints has contributed to the growth of this segment.

The arthroscopic devices (sports medicine/soft tissue repair) segment is expected to expand at a higher growth rate during the forecast period owing to the increase in the introduction of new products in the market and the rise in sports-related soft tissue injuries.

For example, according to data released by the Australian Institute of Health and Welfare, in 2020-2021, the number of people hospitalized in the country due to sports injuries was 66,500. Fractures and soft tissue injuries accounted for 53% and 17% of the total respectively, ranking first.

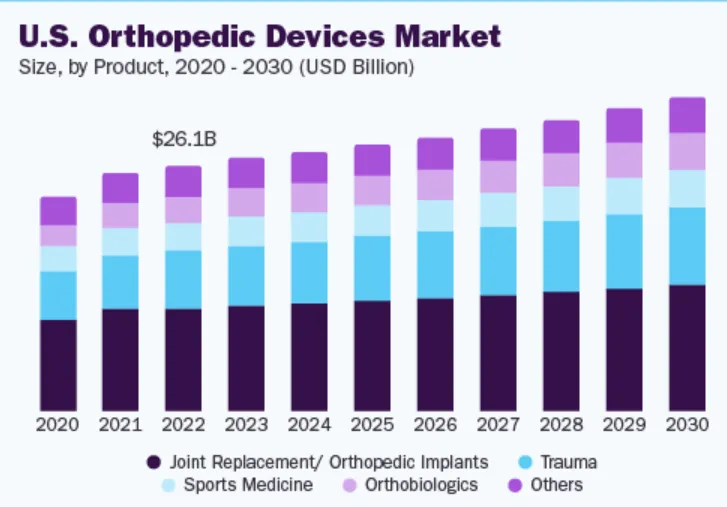

Based on product type, the joint replacement/orthopedic implants segment led the market with the largest revenue share of 41.7% in 2023. The increasing number of joint replacement surgeries globally is boosting the market growth. According to the American College of Rheumatology, more than 450,000 hip replacements and more than 790,000 knee replacement surgeries are performed each year in the United States alone. Additionally, the adoption of robot-assisted joint replacement surgeries is also driving the market. A study titled “Trends in computer-assisted surgery in total knee arthroplasty in Germany: Analysis based on the procedure classification system 2010 to 2021” found that between 2018 and 2021, robot-assisted total knee arthroplasty (R -TKA) surgeries have increased significantly, with an average annual growth rate of 84.74%. Furthermore, the availability of advanced orthopedic implants and the rapid development of healthcare infrastructure across the globe are expected to further positively impact the growth of this segment.

The orthopedic biologics segment is expected to grow at the fastest CAGR during the forecast period. Strategic initiatives taken by key market players to expand their product portfolio and geographical coverage are driving the growth of this segment. In July 2023, Anika Therapeutics Inc. announced that its Tactoset injectable bone substitute had received 510(k) approval from the U.S. Food and Drug Administration (FDA) for use in conjunction with autologous bone marrow aspiration.

Analysis by end user

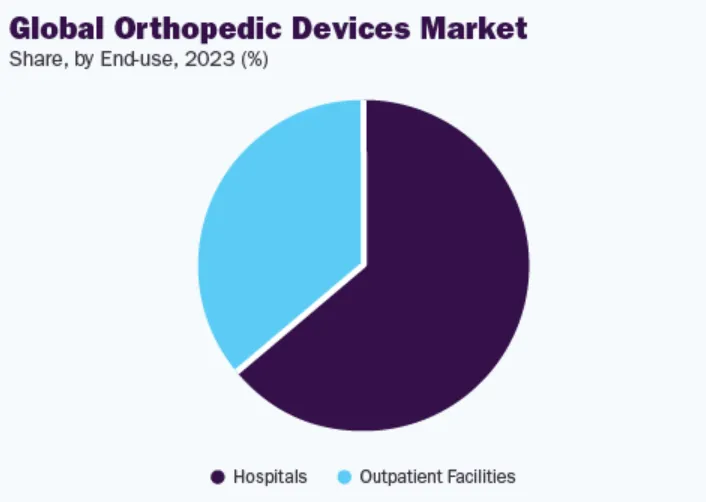

Hospitals will continue to be the dominant segment owing to adequate reimbursement policies offered by hospitals. Based on end users, the market is segmented into hospitals & ambulatory surgery centers (ASCs), orthopedic clinics, and others. The hospital segment held the highest market share in 2023 and is expected to grow at a significant CAGR during the forecast period. Orthopedic devices are primarily used in hospitals because they require surgical implantation. In addition, a large number of patients who suffer orthopedic injuries are treated primarily in hospitals. In addition to treatment, adequate reimbursement policies provided by hospitals are also a key factor leading to a high proportion of patients choosing to receive treatment in hospitals. However, as minimally invasive surgical procedures become more popular, a shift toward ambulatory surgery center preference is expected.

Market factors

driving factors

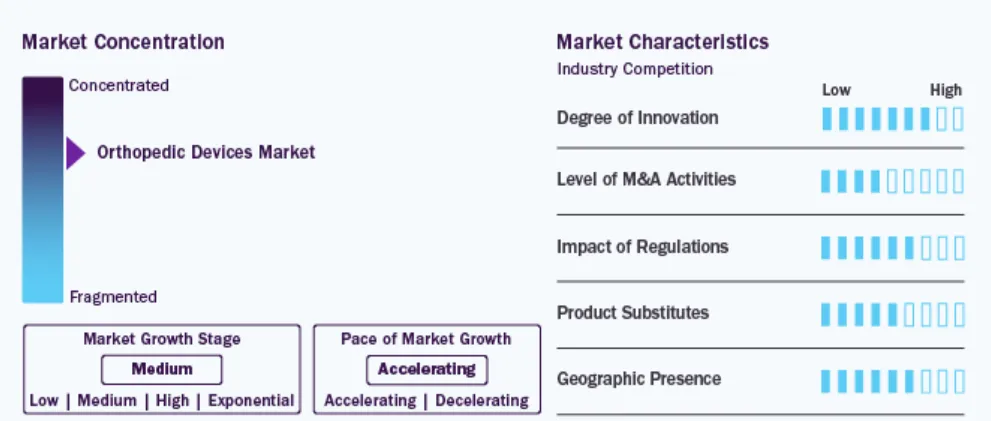

The treatment of orthopedic conditions and injuries has been significantly transformed by recent advances in the field of orthopedic devices. Furthermore, in order to keep pace with demand, major players in the market are investing in innovative technologies and procedures. For example, the “BONEZONE” report pointed out that in 2019 and 2020, the seven largest publicly traded orthopedics companies, including DePuy Synthes, Stryker, and Zimmer Biomet, invested a total of more than $2.3 billion in research and development. In addition, in June 2023, Acuitive Technologies launched a new tenodesis device-Citrelock ACL.

The market is characterized by a high level of mergers and acquisitions (M&A) activity by major players, which is driven by several factors, including the desire to expand operations to meet the growing demand for orthopedic devices and maintain a competitive advantage. In January 2024, Enovis acquired LimaCorporate S.p.A., a world-renowned orthopedic company. This strategic move strengthens Enovis’ position in the global orthopedic reconstruction market by adding Lima’s proven surgical solutions and technologies to its product portfolio.

Orthopedic devices must meet strict regulatory requirements to ensure they meet high quality, safety and effectiveness standards before entering the market. In the United States, the FDA regulates orthopedic medical devices. There are two pathways for regulatory approval of new orthopedic devices: PMA (premarket approval) or 510(k) approval. Most industries use 510(k) premarket notification because it does not require clinical trials. It can be used for devices that are considered substantially equivalent to devices that have been approved by the FDA. However, devices approved through this process may be at risk of being recalled by the US FDA.

Physical therapy and rehabilitation equipment can be considered alternatives to orthopedic instruments. Such equipment includes exercise bands, balance boards, and therapy balls specifically designed to increase strength, flexibility, and range of motion. Technological advances have further led to the development of wearable devices and mobile applications that guide users through customized rehabilitation programs, providing convenience and accessibility.

Some market players are expanding their operations by entering new geographical regions to strengthen their market positions and expand their product portfolios. For example, in January 2024, Tynor Orthotics opened an advanced manufacturing facility in Mohali, Punjab. Likewise, in June 2022, Smith+Nephew expanded its orthopedics business by opening a manufacturing unit in Malaysia, investing more than $100 million.

Limiting Factors

Post-operative complications and high surgical implant costs may hinder market growth. Despite the increasing incidence of orthopedic injuries and the number of elderly people worldwide, high surgical costs and post-operative complications limit market growth. According to Richard Kim Medicine, the average cost of total shoulder replacement in Ohio, USA is $18,165, while in Florida, the same surgery costs about $30,000. These costs have been rising continuously over the past few years.

On the other hand, these surgeries are also accompanied by some risks. The risks and complications associated with orthopedic surgeries include blood oozing, nerve palsy, post-operative infection, dislocation, venous thrombosis, and lack of full range of motion. These factors have limited market growth to a certain extent.

Regional Analysis

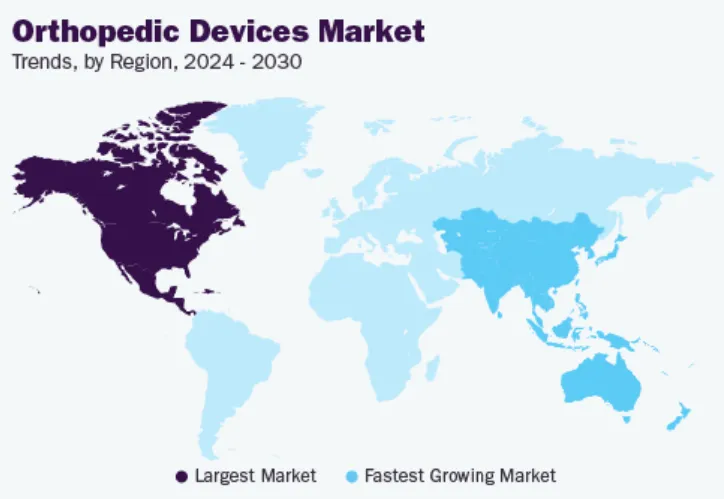

In 2023, the market size in North America reached $32.85 billion. A feature of the market in this region is the increase in the number of orthopedic surgeries and the growing demand for advanced medical services, coupled with adequate reimbursement policies for orthopedic devices. These factors, coupled with the high awareness of patients about technologically advanced orthopedic devices and the existence of new treatment options, have enabled the region to occupy a dominant share in the global market.

Europe holds the second highest market share, primarily due to the increase in the number of surgeries in the region, rising healthcare expenditures among the population, and increased awareness about technologically advanced orthopedic devices. The European orthopedic devices market trends show that the market is expected to grow at a significant CAGR during the forecast period. This trend is primarily attributed to several factors, including rising healthcare expenditures and a rising number of elderly people suffering from osteoarthritis, osteoporosis, bone injuries, and obesity. According to Eurostat, the population of the European Union reached 448.8 million as of January 2023, with 21.3% of the population aged 65 years and above.

The German orthopedic devices market is expected to grow at a considerable CAGR during the forecast period. Osteoarthritis is the second leading reason for hip surgery in most elderly people. According to an article by Elsevier B.V., approximately 1 million patients are diagnosed with knee osteoarthritis in Germany each year, resulting in approximately 5 million people suffering from knee OA each year.

The UK orthopedic devices market is expected to grow at a significant CAGR during the forecast period. The market is likely to witness new growth opportunities during the forecast period due to the reconfiguration of supply chain models by medical device manufacturers and the increase in demand for transplanted organs. Moreover, the orthopedic implant segment is becoming increasingly popular and major companies are launching new products in this segment.

The trends in the Asia Pacific orthopedic device market show that the region is expected to be the fastest-growing regional market. The rapid development of healthcare infrastructure in major countries such as India, China, and Japan and the boom in medical tourism are driving the demand for orthopedic devices in the region. The number of orthopedic implant surgeries performed in the region is growing due to the rising incidence of chronic orthopedic diseases and improved diagnostic tools.

The orthopedic device market in China is expected to grow at the fastest CAGR during the forecast period. This growth is driven by the country’s growing middle class and aging population. The medical industry is booming, healthcare infrastructure is improving, and patient awareness about the commercial availability of orthopedic devices is increasing, all of which are contributing to the growth of the market in the country. However, the high cost of orthopedic surgeries and the government’s strict policies on device approvals have inhibited market growth to a certain extent.

Market competition

Leading market players are focusing on various strategic initiatives such as mergers and acquisitions, collaborations, and partnerships with other organizations to expand their global presence and offer a diverse range of products to customers. New product launches, technological innovations, and geographic expansion are the major market developments used by market players to expand market penetration. Moreover, the orthopedic medical device industry is witnessing a growing trend of local manufacturing to reduce operating costs and offer more cost-effective products to customers.

The diverse product portfolio of implantable orthopedic devices and the launch of new devices due to continuous innovation are the major factors for the growth of companies operating in the market. However, the presence of regional and local players with innovative orthopedic devices has made the market more competitive. This is expected to have an impact of price pressure on the global market. Moreover, integration strategies are becoming the key to success for industry giants.

Overview of Key Companies

Medtronic

Medtronic is a leading global medical technology company with businesses spanning multiple areas including cardiac devices, restorative therapies, diabetes management, and minimally invasive treatments. In the field of orthopedics, Medtronic offers a range of innovative solutions including spine, trauma, and joint reconstruction devices. The company is committed to improving the quality of life of patients through technological innovation and has a wide market presence and strong R&D capabilities around the world.

Stryker

Stryker is known for its innovative products in the fields of orthopedics, medical and neurotechnology. The company focuses on providing high-quality orthopedic implants, surgical navigation systems and robotic-assisted surgical devices. Stryker continues to pursue technological innovation and expands its product line and service scope through mergers and acquisitions to meet the changing market needs and improve clinical treatment outcomes.

Zimmer Biomet

As one of the world’s leading orthopedic medical device manufacturers, Zimmer Biomet specializes in the production of joint reconstruction, spine, trauma, and sports medicine products. The company has won the trust of global customers with its broad product portfolio, strong R&D capabilities, and focus on personalized medical solutions, especially in the field of joint replacement.

DePuy Synthes

A subsidiary of Johnson & Johnson, DePuy Synthes is a top supplier of orthopedic and neurosurgical devices. It provides a range of comprehensive solutions from trauma fixation to joint reconstruction. Through continuous technological innovation and extensive clinical collaboration, the company is committed to providing surgeons with cutting-edge tools to help them better serve their patients.

Smith+Nephew

Smith+Nephew has extensive experience in orthopedics, sports medicine, wound management, and advanced wound care. The company places particular emphasis on arthroscopy and sports medicine products that help minimize the impact of invasive surgery and speed up the patient’s recovery process. Smith & Nephew continues to invest in research and development to ensure that its products are at the forefront of the industry.

Aesculap

As part of B. Braun, Aesculap focuses on the research and development and production of orthopedic, spine, and general surgical instruments. The company not only provides high-quality medical equipment but also provides education and support services to surgeons to ensure that its products can be effectively used in clinical practice and improve surgical success rates.

CONMED Corporation

Conmed Corporation focuses on the development of minimally invasive surgical instruments, and its product line covers multiple fields such as orthopedics, sports medicine, and gastroenterology. With its expertise in minimally invasive technology, the company designs innovative products that can reduce patient pain and accelerate recovery, meeting the needs of modern surgery.

NuVasive, Inc

NuVasive is a leader in spinal surgery technology, especially in minimally invasive spinal surgery. The merger with Globus Medical strengthens the company’s position in the global orthopedic market, with a more comprehensive product portfolio that will provide a wider range of solutions in the areas of spine, trauma, and joint reconstruction.

Enovis

Enovis is committed to providing therapeutic solutions for musculoskeletal health, covering the entire process from prevention to rehabilitation. The company helps patients reduce pain and restore function through its diverse product line, including braces, cold therapy devices and electrical stimulation devices. After the name change, the company continues to innovate to meet the emerging needs of musculoskeletal treatments.

Featured Dynamics

July 2023 – Stryker launches a new autonomous navigation system, Ortho Q Guidance, to improve speed and efficiency. The system is designed to optimize surgical workflow, allowing surgeons to perform surgeries faster and more accurately.

February 2023 – OSSIO, Inc., a fast-growing orthopedic device company, announced the launch of the new OSSIOfiber compression nail. This compression nail allows the company to provide solutions for many rearfoot and midfoot surgeries, including midfoot fusions, Lapidus fusions, and surgeries related to flatfoot correction.

January 2023 – Orthofix Medical Inc., a global spine and orthopedic company, announced the launch of the Mariner Deformity Pedicle Screw System. The system is used to identify the unique clinical requirements of complex adult spinal deformity cases, helping doctors plan and execute surgeries more accurately.

March 2022 – Pixee Medical launched a Knee+ AR computer-assisted orthopedic solution in the United States. Designed specifically for total knee replacements, the new solution claims to be the first augmented reality (AR) guidance system that can help surgeons provide better visual guidance during surgery.

November 2020 – Olympus Corporation announced the acquisition of French orthopedic company FH ORTHO SAS. The acquisition aims to expand Olympus’ orthopedic business segment in the field of minimally invasive surgery and strengthen its market competitiveness in this field.

July 2020 – Smith & Nephew announced the launch of the RI.HIP NAVIGATION system for total hip replacement (THA). The system is designed to maximize accuracy and repeatability by providing patient-specific component alignment, which is a key factor for surgeons evaluating individual THA cases.

These companies have driven the development of orthopedic medical device technology through continuous innovation research and development. Their products and services are changing surgical methods, improving surgical outcomes, reducing surgical risks, and improving patients’ quality of life. At the same time, these dynamics reflect the development trends and competitive landscape of the orthopedic market, including technological innovation, regulatory approvals, market entry and exit, and corporate strategic adjustments. These events not only affected the business direction of the relevant companies but also provided patients with more advanced and safer treatment options, driving the entire industry forward.

Patent matters deserve attention

With the increasing competition in the field of orthopedic medical device technology, patent affairs have become an indispensable part of enterprises. Doing a good job of patent layout can not only protect the company’s innovative achievements, but also provide strong legal support for the company in market competition.

First, enterprises need to pay attention to the application and protection of patents. In the process of research and development, once there is a new technological breakthrough or innovation, patents should be applied for in a timely manner to ensure that their own technological achievements are legally protected. At the same time, enterprises also need to regularly maintain and manage existing patents to ensure their effectiveness and stability.

Secondly, enterprises need to establish a sound patent early warning mechanism. By regularly retrieving and analyzing patent information in related fields, enterprises can keep abreast of technological development trends and the dynamics of competitors, thereby avoiding possible patent infringement risks. Once the risk of infringement is found, the company should take prompt measures to respond, such as seeking patent licenses, making technical improvements or adjusting market strategies.

In addition, enterprises also need to be prepared to deal with patent wars. In a highly competitive market environment, patent wars may break out at any time. Therefore, enterprises need to formulate response strategies in advance, such as establishing a dedicated legal team and reserving sufficient funds for possible patent litigation. At the same time, companies can also enhance their patent strength and market influence by establishing patent alliances with partners and participating in the formulation of industry standards.

In the field of orthopedic medical devices, the complexity and professionalism of patent affairs are extremely high. Therefore, it is particularly important to find dedicated, high-level professionals and teams focused on this field. Such a team not only has a deep legal and technical background, but also can accurately understand and grasp the core points and market dynamics of orthopedic medical device technology. Their professional knowledge and experience will bring accurate, efficient, high-quality and low-cost patent affairs services to enterprises, helping enterprises stand out in the fierce market competition. If you need to communicate, please scan the QR code below to add Medical IP Jun to get in touch.

Disclaimer:

This article and all articles on this website are for reference only by medical professionals; specific medical problems should be treated promptly. To ensure “originality” and improve delivery efficiency, some articles on this website are AI-generated and machine-translated, which may be inappropriate or even wrong. Please refer to the original English text or leave a message if necessary. Copyright belongs to the original author. If your rights are violated, please contact the backstage to delete them. If you have any questions, please leave a message through the backstage, or leave a message below this article. Thank you!

Like and share, your hands will be left with the fragrance!