The global orthopedic implants market is experiencing significant growth, driven by the rising prevalence of orthopedic diseases, advancements in surgical techniques, and increasing healthcare accessibility in emerging economies. With a projected CAGR of 4.8% from 2024 to 2029, the market is expected to grow from $20.94 billion in 2024 to $26.47 billion by 2029. In this article, we delve into the key drivers, challenges, and opportunities shaping this dynamic market.

Market Overview

Orthopedic implants play a crucial role in treating bone-related conditions, especially among the aging population. The increasing prevalence of osteoporosis, osteoarthritis, and trauma-induced fractures has fueled the demand for innovative implant solutions. North America is poised to dominate the market, thanks to its high healthcare expenditure, advanced medical infrastructure, and the presence of major players. Meanwhile, emerging economies like India and China are creating new opportunities due to rising disposable incomes and improvements in healthcare accessibility.

Key Market Highlights:

- Rising prevalence of orthopedic disorders among aging populations globally.

- Increased adoption of robotic-assisted surgeries and 3D-printed implants.

- The shift from inpatient hospital care to outpatient surgical centers.

- Challenges such as high costs of orthopedic surgeries and a shortage of skilled surgeons.

Market Dynamics

1. Drivers

Rising Prevalence of Orthopedic Diseases

The aging population is a significant contributor to the growth of the orthopedic implants market. According to the United Nations, the population aged 65 and above is expected to double, from 727 million in 2020 to 1.5 billion by 2050. This demographic shift is increasing the prevalence of age-related bone diseases like osteoporosis and degenerative joint disorders. For instance, the CDC reports that over 300,000 Americans aged 65+ are hospitalized annually due to hip fractures. These statistics underscore the growing need for advanced orthopedic solutions.

2. Restraints

High Costs of Orthopedic Surgeries

Orthopedic procedures, such as knee and hip replacements, are among the most effective treatments but come with a hefty price tag. The complexity of materials, engineering precision, and advanced technologies drive up costs. For example, the average cost of a knee replacement in India ranges from $5,500 to $11,500, while in the U.S., robotic-assisted knee replacement surgeries are 10% more expensive than traditional methods. These high costs limit access to care, particularly in regions with lower insurance penetration and disposable incomes.

3. Opportunities

Advancements in Robotic Surgery and 3D Printing

The integration of robotic-assisted technologies and 3D printing is revolutionizing the orthopedic implants market. Robotic systems, like Stryker’s Mako Smart Robotics, enable precise implant placement, reducing complications and improving recovery times. Additionally, 3D printing allows for the creation of customized implants tailored to individual patients, enhancing surgical outcomes. Studies published in the Global Health Journal highlight that 3D-printed models can reduce development costs and improve surgical planning, making them a game-changer for the industry.

4. Challenges

Shortage of Skilled Surgeons

Despite advancements in technology, the market faces a significant challenge: the lack of skilled orthopedic surgeons. The American Academy of Orthopedic Surgeons predicts a shortage of 5,080 orthopedic surgeons in the U.S. by 2025. This shortage not only increases patient wait times but also limits access to high-quality care. Furthermore, a large percentage of practicing surgeons are nearing retirement age, exacerbating the issue.

Market Analysis

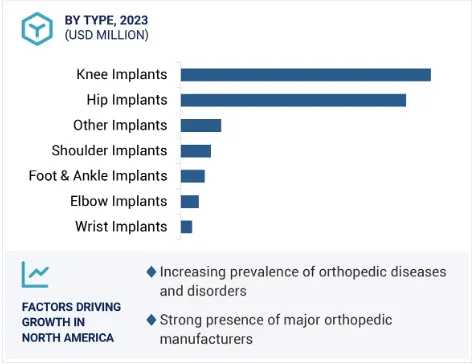

By Type

- Knee Implants: This segment held the largest share in 2023, driven by the rising prevalence of knee osteoarthritis. Innovations like Zimmer Biomet’s Persona OsseoTi Keel Tibia implant are further boosting adoption.

- Hip Implants: Increasing hip fracture rates among the elderly are fueling growth in this segment.

By Material

- Metals and Alloys: Materials like titanium and cobalt-chromium alloys dominate due to their durability and biocompatibility.

- Polymers and Ceramics: These materials are gaining traction for their lightweight properties and reduced risk of allergic reactions.

By End User

- Hospitals and Surgical Centers: This segment accounts for the largest market share, thanks to the availability of advanced surgical technologies.

- Outpatient and Trauma Care Centers: Expected to witness faster growth due to the increasing shift toward minimally invasive procedures.

Regional Insights

North America

North America is projected to remain the largest market, driven by:

- A high prevalence of orthopedic diseases.

- The adoption of advanced technologies like robotic-assisted surgeries.

- Favorable reimbursement policies.

Emerging Markets

Countries like India and China present significant growth opportunities due to:

- Rising healthcare investments.

- Increasing awareness of advanced orthopedic treatments.

- A growing middle-class population with higher disposable incomes.

Recent Developments

- Stryker (USA) acquired 4WEB Medical’s osteotomy and ankle truss systems in September 2024 to expand its foot and ankle portfolio.

- Smith+Nephew (UK) launched its LEGION Hinged Knee (HK) System in October 2024 to address complex knee conditions.

- Johnson & Johnson Medical Technologies (USA) received FDA approval for its TriLEAP System, a cutting-edge solution for bone fixation.

Key Players in the Market

The orthopedic implants market is highly competitive, with major players focusing on innovation and strategic collaborations. Key companies include:

- Stryker Corporation (USA)

- Zimmer Biomet Holdings, Inc. (USA)

- Smith+Nephew (UK)

- Johnson & Johnson Medical Technologies (USA)

- B. Braun (Germany)

- Globus Medical, Inc. (USA)

Disclaimer:

This article and all articles on this website are for reference only by medical professionals; specific medical problems should be treated promptly. To ensure “originality” and improve delivery efficiency, some articles on this website are AI-generated and machine-translated, which may be inappropriate or even wrong. Please refer to the original English text or leave a message if necessary. Copyright belongs to the original author. If your rights are violated, please contact the backstage to delete them. If you have any questions, please leave a message through the backstage, or leave a message below this article. Thank you!

Like and share, your hands will be left with the fragrance!